Welcome to the 77th edition of ‘The Digital Asset Digest’. Today, we give you our top 3 picks for crypto startups of 2021 and talk about 3 tokens that offer the best yields at the moment.

SNIPPETS

Culture converges with blockchain as luxury fashion brands launch NFT collections

Source: CoinTelegraph

“It’s no surprise that nonfungible tokens (NFT) have been dominating the crypto market this year. The booming digital asset class generated over $2.5 billion in sales within the first six months of 2021, demonstrating unheard-of financial gains for artists, brands, and content creators across the globe.”

CME Bitcoin Futures Now Cost More Than BTC Itself, Here’s Why

Source: U.Today

“With the first Bitcoin futures, ETF starts trading in the U.S., and the country’s investors and retail traders cannot miss the opportunity to receive convenient exposure to the crypto market without going through the relatively complicated process of actually purchasing crypto. But high demand, unfortunately, creates the “contango effect” that is not welcome among futures-backed ETF investors.”

Korea teachers’ union denies crypto media reports, will ‘never have’ Bitcoin ETF plan

Source: Protos

“The Korea Teachers’ Credit Union (KTCU) has denied that it will invest any of its $34 billion worth of assets in Bitcoin via an Exchange Traded Fund (ETF).“

Vitalik Buterin: Layer 2 is the future of Ethereum scaling

Source: Forkast

“Ethereum, the second-largest cryptocurrency after Bitcoin, crossed the US$500 billion market cap mark for the first time this month, according to CoinGecko data. Amid the explosive growth of decentralized finance (DeFi) and non-fungible tokens (NFTs), scalability has been a key issue for Ethereum as the applications and number of users continue to grow.“

Tokenized Cash-Flow DeFi Project Swivel Finance Raises $3.5M

Source: Decrypt

“In DeFi’s volatile lending and borrowing sector, fixed-rate lending services are fast gaining attention. Swivel Finance is the latest to turn investors’ heads.“

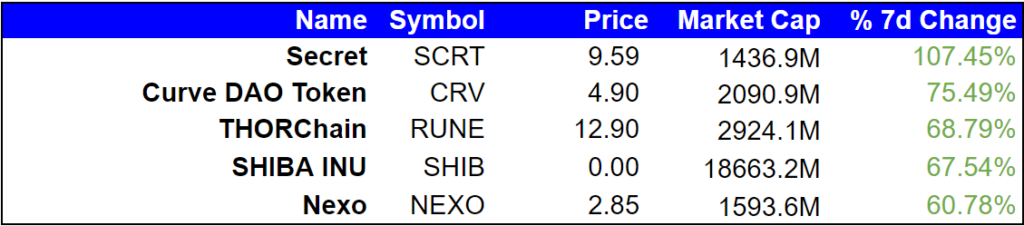

TOP GAINERS

TOP LOSERS

INDUSTRY WIDE SNAPSHOT

MARKET BREAKDOWN

3 Tokens Offering the Best Yields Right Now

The global financial industry is being rapidly disrupted by blockchain technology. Smart contracts and digital assets have already displaced gold, precious metals, marketplaces and investments. It was only a matter of time before the tech displaced the most basic financial operations of borrowing and lending.

Decentralized Finance or DeFi has emerged as an alternative to traditional bonds and savings accounts. The promise is higher interest rates for lenders and better terms for borrowers. Alas, the field is crowded with volatile assets and unpredictable yields. Investors must seek out DeFi strategies that offer the perfect balance between risks and rewards.

With that in mind, here are the top three tokens that can be used to generate a yield right now.

EXPLORING NEW IDEAS

Top 3 Crypto Startups of 2021

The digital assets sector has had an incredible run in 2021. After Bitcoin and Ethereum surged to all-time highs, investors poured billions of dollars into emerging startups that serve this expanding sector.

Some of these startups raised more capital and gathered more users than ever before. Here are the top three most successful or noteworthy crypto startups of 2021.

TOKEN OF THE WEEK

Thorchain / Rune

Thorchain is an independent blockchain network that seeks to make all cryptocurrencies liquid. Built on the Cosmos protocol, it aims to enable easy trading of non-native crypto assets. While it operates similarly to centralized exchanges such as Coinbase and Binance, it seeks to do away with third parties taking control of people’s funds.

THIS WEEK’S DEEP READ

US SEC May Steer Stablecoin Regulation, New Rules to be Detailed Soon (Report)

Source: CryptoPotato

“According to a recent report, the United States Securities and Exchange Commission is gearing up to propose regulations for the stablecoins market.”

And that’s all for today! Like what you hear and want to explore an investing relationship through GDA?