About

Global Digital Assets for disruptive technology

Global Digital Assets blockchain investing

Our Mission

Our mission is to make blockchains, digital assets and other disruptive technologies mainstream by powering the strongest networks of the world of tomorrow.

We believe that a rising tide lifts all boats and we are committed to working with all participants in the blockchain and digital asset ecosystem who share a similar mission of pushing this industry forward.

Our Values

We believe in a decentralized future and are committed to spreading the values of decentralization. We are also passionate about using the relationships, access and capital we have acquired from our role in pioneering the financial revolution to give back to the world and solve problems that can lead to a better tomorrow.

We value transparency, freedom and universally available access to information and value.

Our Experience

GDA Capital works with all blockchain ecosystems and offers solutions that are uniquely tailored to every client, transaction or offering. We are always a partner in any offering and are aligned in the success of the project. We are experienced working with institutions, Fortune 500 companies, governments and we have advised or provided growth capital to the largest digital asset networks and disruptive technology projects.

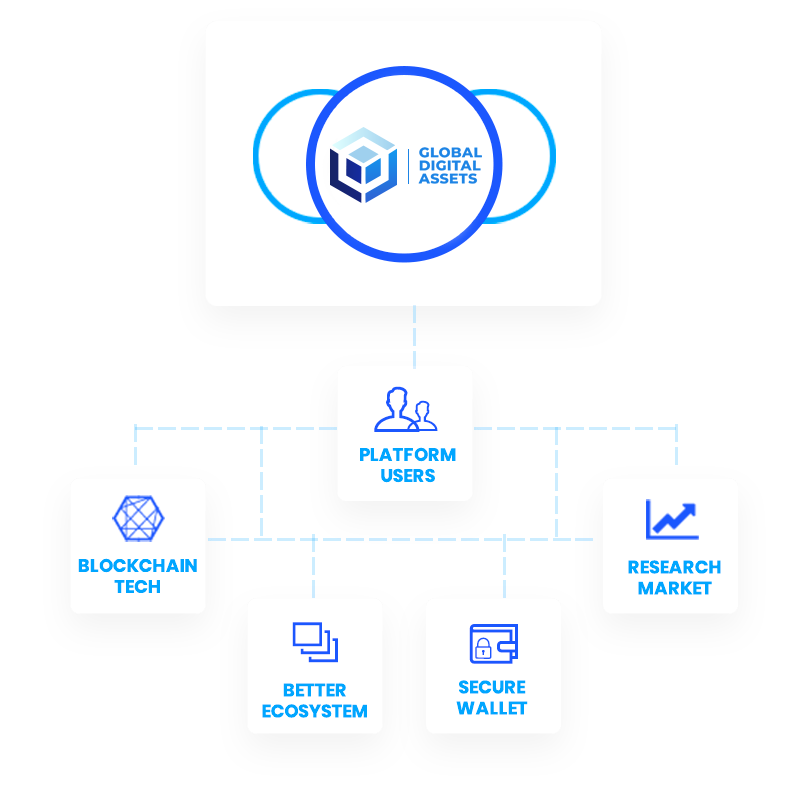

GDA Ecosystem & Group of Companies

Capital Markets

GDA Capital, the capital markets arm of the GDA Group of Companies, provides solutions to financial technology, blockchain, digital asset and other disruptive technology businesses.

GDA executives have a world leading track record of experience executing on projects for Fortune 500 companies, governments and digital asset offerings from the venture incubation phase to liquidity.

Collaterized Loans

Global Digital Assets (GDA) Lending, the collaterized lending division of the GDA Group of Companies, is focused on providing and bringing our clients access to non recourse lending for the digital financial markets Using decades of experience in the traditional financial markets we bring the same professionalism, care and practises you would expect.

GDA Lending provides lending not only on digital assets but also on the infrastructure that surrounds them such as bitcoin or other digital asset mining equipment. We understand the inherent risks associated with digital assets and we’ve built out collaterized lending models that bring the largest access to capital with the best rates to out clients.

Let us help you to maximize the value of your assets. We are comfortable with lending amounts as low as 100k and as high as tens of millions of dollars.

“Credit is not something a bank gives to its clients, credit on the contrary is something it’s clients already have.”

Venture Incubation

Global Digital Asset (GDA) Ventures, the venture incubation firm in the GDA Group of Companies, is focused on building the next generation of disruptive technology companies by providing access to the global resources, infrastructure and relationships and capital parters to high performing young companies in exchange for equity.

GDA Ventures has previously worked with early stage companies across North America, South America, Europe and Asia to structure their corporations in the most favourable jurisdictions, plan and execute on their go to market strategies, expand globally through strategic partnerships and raise capital.

GDA Ventures aims to recreate the global success they have achieved for every other disruptive founder.

Family Office Network

GDA Wealth, the family office wealth network in the GDA Group of Companies, is focused on building the next generation wealth network who are focused on disruptive technologies such as blockchains and digital assets, artificial intelligence, robotics, e-sports, nano and green energy technologies, among others.

The Global Family Office Summit is a quarterly event bringing together innovative asset managers, more traditional family offices and private equity firms, global regulators and unicorn disruptors to discuss technology that is changing the world.