Welcome to the 35th edition of ‘The Digital Asset Digest’. Today we’re here to celebrate a new (and continuing) high for Bitcoin, as well as sharing a DeFi tool we think you’ll love.

How Industry Financial Services Are Buoying North American Bitcoin Mining

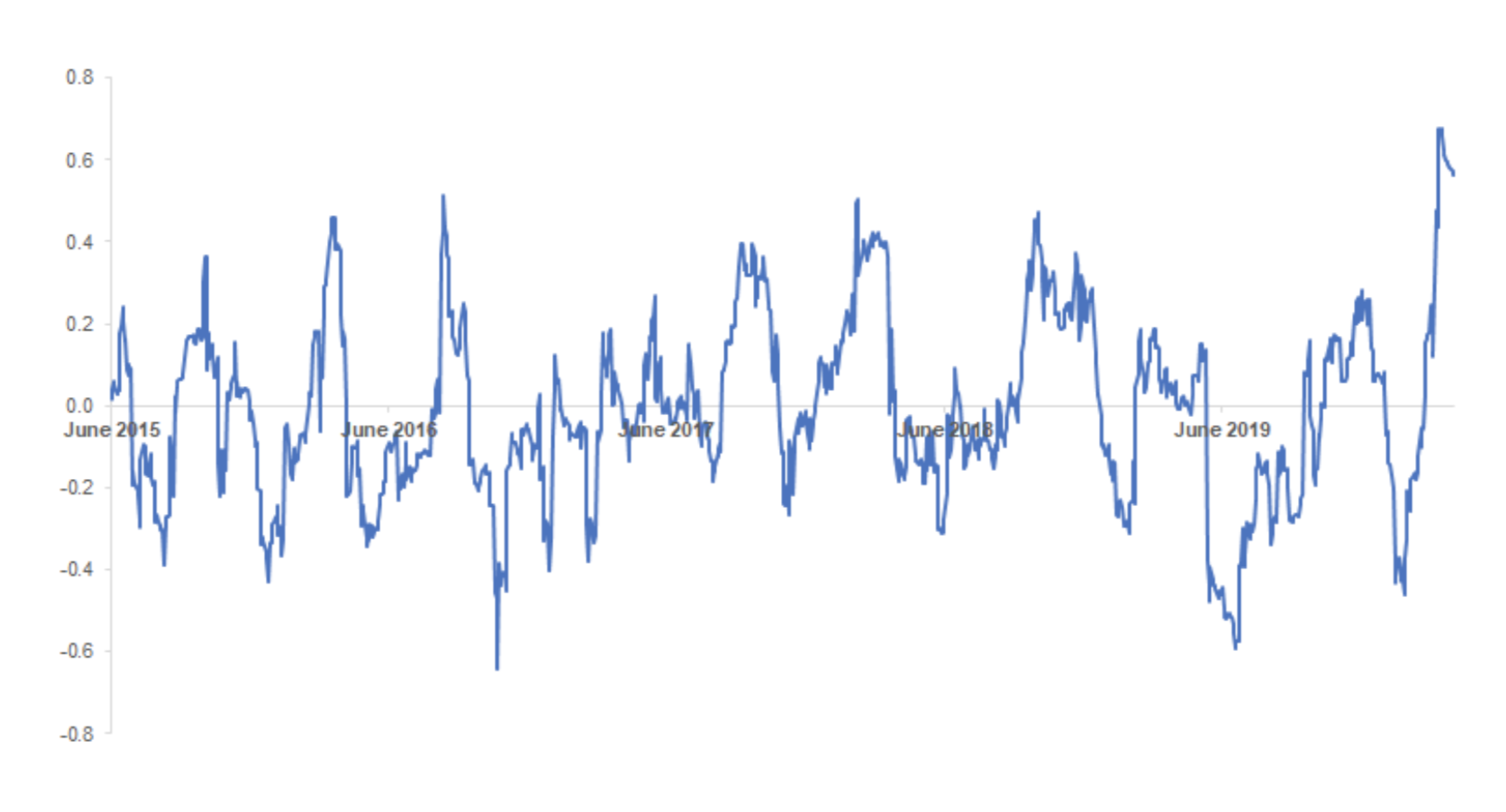

Source: Nasdaq

“This year, there has been a concerted effort among Bitcoin mining pools and facilities based in North America to contribute a higher proportion of the Bitcoin network’s overall hash rate from the continent, providing critical decentralization to this system. But this has not been without its challenges. The Bitcoin mining environment is one with high costs and a challenging supply chain. To help buoy these North American entrants, Bitcoin-focused companies are playing a role typically filled by mainstream financial institutions like banks, carving out a new niche in providing financial advice and services to the fledgling North American mining industry.”

JP Morgan using blockchain for repos, but it’s not the first

Source: Ledger Insights

“Today JP Morgan announced that its Onyx blockchain unit has developed a repo transaction platform. The key differentiator is targeting intraday repo transactions, which blockchain can enable with instantaneous settlement using JPM Coin. However, Broadridge, which processes repo transactions for 19 of the 24 primary dealers in the U.S., first piloted its DLT Repo platform in 2017. More on that later.”

MicroStrategy to Raise $400 Million to Buy Even More Bitcoin

Source: Bloomberg

“MicroStrategy Inc. is doubling down on its Bitcoin bet, saying Monday that it plans to offer $400 million of convertible bonds in order to buy more of the cryptocurrency. The proceeds from the offering will be invested in Bitcoin “pending the identification of working capital needs,” the Virginia-based company said in statement. MicroStrategy bills itself as a business-intelligence firm but has been doubling down on its capital-allocation strategy disclosed in July, which included investing up to $250 million in assets including Bitcoin.”

Insider Reports Suggest Chinese Miners Are Laser Focused On Ethereum Mining

Source: Cryptoticker

“Ethereum has recently started the transition towards the Proof Of Stake (POS) with the launch of Eth2 Phase 0 and the deposit contract. It’s still in motion and it won’t be until planned Phase 1.5 that the current Proof Of Work (POW) will stop being functional completely. Now, naturally this should discourage miners from purchasing further equipment or expanding their operation, however surprisingly insider reports suggest that the opposite is true.”

GDA Announces Investment Into Lattice Exchange

Source: Global Digital Assets

As many of you know, GDA along with several other leading capital markets firms led a strategic investment into Lattice, a decentralized exchange built with the Constellation protocol. Being both a strategic investor and advisor, our goal is to help the Lattice Exchange maintain decentralization across their community. With this in mind, we are sharing the Lattice LTX token’s latest distribution schedule as a way to help decentralize all corporate communications and key announcements. This new schedule spreads out the token releases in order to preserve a decentralized environment and mitigates against monopolization of the network.

TOP GAINERS

TOP LOSERS

INDUSTRY WIDE SNAPSHOT

Every week, we try to provide a new way to make money in the DeFi space. Sometimes this is a new tool, sometimes it’s an angle that we haven’t seen talked about anywhere else, and sometimes it’s an arbitrage opportunity.

This week, we want to talk about a tool we’ve found that makes it way easier to assess different liquidity pools based on their past performance.

Our friends at Novum Insights created this DeFi Calculator that quickly calculates what the investor would have gained or lost by putting money into a certain liquidity pool on Uniswap.

What we love about it is that it also compares the returns of the liquidity pool to that of buy and hold. There’s nothing worse than trying to get sophisticated with your investing when buy and hold would have performed better, and this calculator helps you quickly find the truth of the matter.

The Excel sheet I was using before was an absolute mess, so I welcome the creation of tools like this. And on a broader scale, we’ll see many more of these types of tools come to market. They mean 2 things:

DeFi is picking up enough steam to warrant having 3rd party tools that help simplify some of the information.

The simplification of this information will allow less sophisticated users to enter the market.

Novum Insights has more tools coming, so we recommend you check out their website and bookmark it for future reference

How the U.S. Military Buys Location Data from Ordinary Apps

Source: Vice

“The U.S. military is buying the granular movement data of people around the world, harvested from innocuous-seeming apps, Motherboard has learned. The most popular app among a group Motherboard analyzed connected to this sort of data sale is a Muslim prayer and Quran app that has more than 98 million downloads worldwide. Others include a Muslim dating app, a popular Craigslist app, an app for following storms, and a “level” app that can be used to help, for example, install shelves in a bedroom.”

The price of Bitcoin has increased from last Friday when it was sitting on $17,582 at its lowest point. From there we have seen an increase of 10.39% measured to its highest point at $19,409 made yesterday. Currently, the price is being traded slightly lower as it started moving sideways from yesterday’s high but is overall still in an upward trajectory.

Source: Trading View

Looking at the hourly chart, we can see that yesterday’s high was an interaction with the lower horizontal level from the all-time high zone. As the price made it slightly above and entered the zone again it was pushed back out below it.

We have seen a breakout from the descending channel that formed since the start of the month which is a bullish sign, but the push below the significant horizontal level might be an indication that the resistance there would be stronger than the upward momentum previously seen.

If this ascending move is the continuation of the uptrend that started from the 26th of November then it would surpass the December 1st high, effectively making a new all-time high. Considering that the price retraced back to the 0.618 Fib level this could have been the 2nd wave out of the next five-wave count, but the previously seen upside move looks more like a corrective ABC.

If we are seeing the correction further developing then from these levels the price heads down, but if it continues moving up and surpasses the December 1st high it would mean that we are seeing further impulsiveness. This is why the lower horizontal level serves as a pivot point for validating these possibilities.

This concludes another issue of the ‘Digital Asset Digest’. We hope you enjoyed this week’s edition. We are constantly making changes and are always open to feedback.

On another note, last week our research team put out a piece on the cryptocurrency mining industry that even got reshared on Coindesk. To check out this free report, click here!