Jack Dorsey triggered a fresh escalation in the most debated digital assets sector: Bitcoin vs. Web3. In other words, the philosophical gap between Bitcoin maximalists and proponents of a decentralized internet has widened in recent weeks. Here’s an overview of the debate and what it means for the industry’s future.

The Web3 debate

For two years after its inception, Bitcoin was the only digital asset in the world. It was the first example of how blockchain technology could be used to create scarcity in the virtual world. Soon after, a core community of users emerged who envisioned this asset replacing the world’s most powerful fiat currencies, including the US dollar.

However, in 2011 a group of developers spun off the underlying BTC code to create a new cryptocurrency called Litecoin. This split the community into two camps: those who believe BTC is the ultimate and only digital asset worth considering and those who believe the underlying blockchain technology could spawn an entirely new layer of the global internet. In short, the BTC vs. Web3.0 debate was born.

Fast forward to 2022, and the digital assets sector has over 17,055 tokens traded on over 457 exchanges and is collectively worth $1.6 trillion. These digital assets range from Ethereum, a smart contract network, to Dogecoin, a token created specifically to parody the cryptocurrency sector.

The universe of digital assets has expanded. While this expansion has created immense wealth for early backers and a new opportunity to build tools for developers, some argue that it has taken resources away from BTC. One of the most prominent critics of this expansion seems to be the founder of Twitter and Block.

Jack Dorsey has criticized Web3 for being more decentralized than Bitcoin. He’s also argued that investors with deep pockets, such as venture capitalists, have used their wealth to exert disproportionate control over the industry.

Bitcoin Maximalists like Dorsey see the involvement of corporations and investors as a compromise of Bitcoin’s core principles for the sake of profit. However, this argument goes against other principles the crypto community has adopted, such as free markets and individual choice.

The free market

Bitcoin’s rise was driven by organic supply and demand factors. These same factors have also created a market for other digital assets. While the demand for Non-Fungible Tokens, Decentralized Finance products, fast transactions, low fees, and more liquidity are all proven, BTC is simply incapable of meeting this demand.

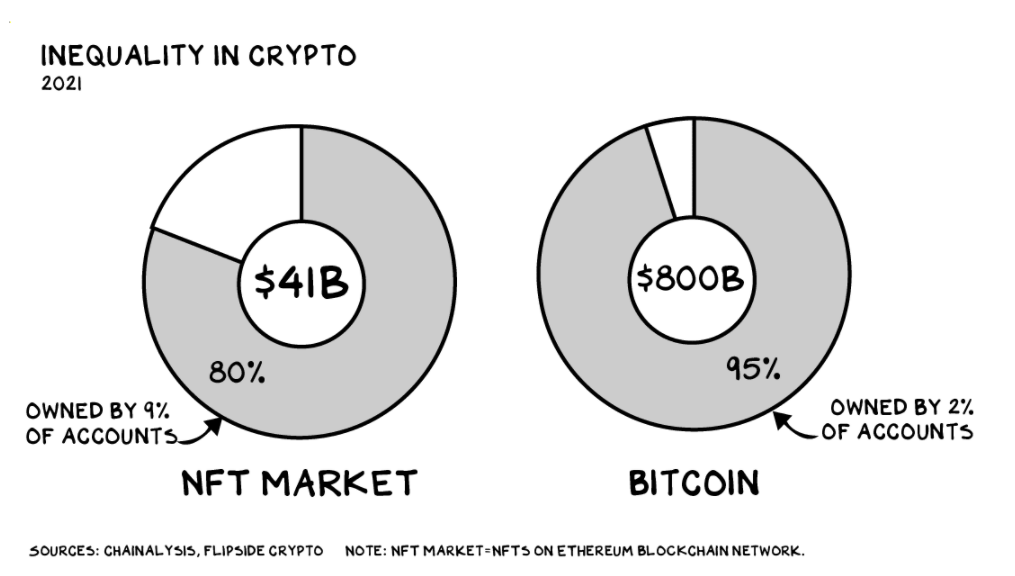

Meanwhile, most Web3 products and platforms seem more decentralized than BTC because of the fragmentation of ownership. While 9% of accounts control 80% of the NFT market, only 2% of BTC accounts control 95% of the outstanding Bitcoin supply.

Bottom line

The BTC vs. Web3 debate may never be settled, but there is a clear demand for use cases of blockchain technology that go beyond Bitcoin’s store-of-value.