Welcome to the 59th edition of ‘The Digital Asset Digest’. Today, China takes another big swing at Bitcoin, and we look at the differences between PoW and PoS.

SNIPPETS

DeFi hub Karura emerges as first Kusama parachain slot auction winner

Source: CoinTelegraph

“According to an announcement issued on Tuesday, Karura pulled support from over 15,000 entities who staked Kusama (KSM) tokens in favor of adding the decentralized finance hub as the first Kusama parachain.”

El Salvador Opposition Party Files Lawsuit Against Bitcoin Adoption Ruling

Source: BeInCrypto

“A citizen group in El Salvador, led by opposition politician Jaime Guevara, filed a lawsuit against the country for adopting bitcoin as legal tender.”

Jed McCaleb Sells 214.6 Million In Last Three Weeks: Report by XRPScan

Source: U.Today

“Recent data says that co-founder of Ripple has dumped almost 215 million XRP within slightly less than past three weeks.“

DCG plans to buy $50 million in Grayscale’s ETC Trust shares as discount persists

Source: The Block

“Digital Currency Group (DCG), the parent company of crypto asset manager Grayscale, announced Monday a plan to buy up to $50 million in shares of Grayscale’s Ethereum Classic (ETC) Trust.”

Digital Shekel: Israel’s CBDC Project Is Well Underway

Source: Bitcoinist

“Israel is the latest country to admit it’s been working in a Central Bank Digital Currency for a few years now. While giving a conference in the Fair Value Forum, Bank of Israel Deputy Governor Andrew Abir said that the institution he represents already ran a pilot program for the digital shekel.”

TOP GAINERS

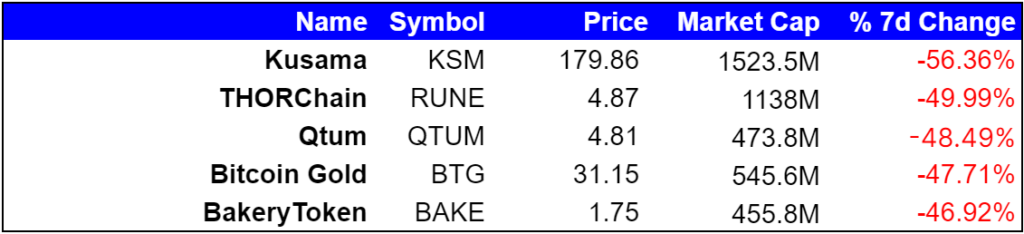

TOP LOSERS

INDUSTRY WIDE SNAPSHOT

MARKET OUTLOOK

China is Clamping Down on Bitcoin – Again!

Ethereum’s developers have been relentlessly testing ways Authorities in China have renewed their crackdown on the world’s most popular cryptocurrency. The new sweep of regulations has already had an impact on Bitcoin’s market value and the global mining industry. Here’s a closer look at why this isn’t the first time the nation has tried to stem the growth of digital assets and what investors should expect on the road ahead.

Bitcoin crackdown

Last week, regulators in China’s north and southwest regions simultaneously announced a ban on cryptocurrency mining. Collectively, these regions account for 90% of BTC mining that occurs in China. Chinese miners also account for 65% to 75% of the world’s bitcoin mining capacity at the moment. In other words, the industry is about to be reshaped dramatically.

This crackdown is also being enacted on a federal level. This week, the People’s Bank of China issued a statement to financial institutions ordering them to cut off payment channels for crypto exchanges and over-the-counter platforms. Following the guidelines, the Agricultural Bank of China (AgBank), China’s third-largest lender by assets, has announced that crypto-related transactions will be suspended shortly.

Chinese authorities see the rise of cryptocurrencies as a financial and environmental risk. The industry’s impact on the energy grid and the traditional financial system has made some Chinese leaders wary. However, this isn’t the first time the nation has tried to stem Bitcoin’s growth.

China’s previous attempts

The country’s approach to digital assets has always been cautious. In 2013, financial institutions received a notice from the China Securities Regulatory Commission asking them to stop handling BTC transactions. That marked the end of the 2013 bull run.

In 2017, at the end of another bull run, the central bank declared initial coin offerings as illegal. ICOs collapsed, while BTC slumped from its all-time high.

The latest crackdown could mark the end of the 2020-2021 bull run. It could also highlight the fact that users and businesses in China have adopted digital assets despite the national crackdowns. Digital assets have become more popular and more mainstream despite two previous crackdowns. This time could be no different.

Long-term impact

As Chinese miners go offline, the time it takes to mine each BTC is prolonged meaning the network will slow down. Industry insiders expect an exodus of miners to other parts of the world with higher concentrations of renewable energy. This exodus could make the Bitcoin network cleaner and more decentralized over the next few years.

The move could also make digital assets appear less threatening in other parts of the world. Concerns about a single country dominating the network or weaponizing it to disrupt the global financial order should subside in the near term. This could push adoption to new heights over the long term.

Takeaway

China’s crackdown on Bitcoin is harsh, but not new. It has previously restricted digital assets during the bull runs of 2013 and 2017. This latest swathe of measures could deflate the market and eradicate speculation, but could also make the global network more robust over the long term.

EXPLORING NEW IDEAS

PoS vs. PoW: Settling the Mining Debate

Bitcoin mining is back in the spotlight. China’s latest clampdown on the cryptocurrency seems to be driven, at least in part, by the environmental concerns of running the network. Meanwhile, billionaire tech tycoon Elon Musk has suspended BTC payments for this very reason.

The world’s largest digital asset relies on a framework that is quickly going out of vogue. The second-largest asset is in the process of switching away from this framework. Ethereum could swap the proof-of-work mechanism for proof-of-stake within the next year. For investors and developers, here’s why the switch is so consequential.

History

Decentralized platforms need a way to reach consensus amongst users. In other words, the group needs a way to settle transactions, verify authenticity and impose rules. This is known as the consensus mechanism.

Satoshi Nakamoto, the creator of Bitcoin, adopted the proof-of-work (PoW) mechanism that was created by Cynthia Dwork and Moni Naor in 1993 as a way to deter denial-of-service attacks. A processing chip needs to do some work (in this case, solve a computational puzzle) to verify transactions and receive a reward. This reward is freshly minted BTC.

When it was first launched, the computational power required to receive a reward was so minimal that commercial laptops could achieve it. Now, the competitive pressures and value of the potential reward are so high that the network collectively consumes as much energy as Argentina, according to some estimates.

The split

Most early cryptocurrencies, including Ethereum, are based on the PoW mechanism. However, Ethereum creator Vitalik Buterin has signaled a shift in his philosophy about consensus mechanisms. He now believes “[Proof-of-Stake] PoS is a superior blockchain security mechanism compared to PoW.”

In PoS, users reach a consensus by putting their own economic interests at stake. In other words, it doesn’t rely on burning fuel or using computational power but rather the threat of losing economic value to incentivize users to reach consensus in good faith.

Ethereum’s transition to PoS is already underway. An upgrade expected sometime between 2021 and 2022 will complete this transition. Developers claim the shift will help make the network more scalable, less expensive, and more environmentally friendly. Since this mechanism is entirely virtual, regulators could find it more difficult to clamp down on. This may prevent situations such as the ongoing expulsion of Bitcoin miners from China.

The most common criticism of PoS is that it is less secure. However, Buterin argues that attacking a PoS system is much more expensive than attacking a PoW one. He estimates that the cost to extract $1 worth of value from a GPU-based POW mining platform is roughly ~$0.26, whereas the costs to attack a PoS system could be as high as $0.90 per day.

There are also ways to prevent 51% attacks or physical attacks that PoW systems are vulnerable to. However, it could be several years before the PoS system has built up a track record of success that matches Bitcoin’s robust PoW.

Bottom line

On paper, PoS appears to be technically superior to PoW. It consumes less energy, could be more secure, and is less vulnerable to regulatory attacks. However, whether this new system stands the test of time remains to be seen.

TOKEN OF THE WEEK

Token of the Week: Polygon (Matic)

Launched in 2017, Polygon is turning out to be one of the most consequential blockchain projects in the industry.

Polygon wants to take on Ethereum in a unique way. Founded by three Indians, Sanded Nailwal, Anurag Arjun, and Jayanti Kanani, what makes Polygon special is that it’s not influenced by high transaction fees. Instead, Polygon is an open-source blockchain project that seeks to offer developers all the tools they need to implement standalone networks and secure sidechains. By leveraging the security of the Ethereum network, it also provides a platform that people can use to develop secure smart contracts.

Polygon seeks to address some of the challenges that have taken a toll on Ethereum, hindering its mass-market adoption. It aims to address the high fees, poor user experience, and low transaction throughput, involved with many blockchain projects. It also solves several scalability issues that have clobbered Ethereum blockchain for years.

Tokenomics

Polygon offers several modules that developers can use to customize their blockchain. For instance, people can use the tools available to configure consensus on the blockchain and governance modules.

Additionally, it provides a simple to use framework that developers can use to launch their own custom Ethereum-compatible blockchains. In the long run, it envisions a world of distinct blockchains capable of interacting with one another freely to exchange value and information.

The platform leverages a proof-of-stake side chain that uses a network of validators to speed up transactions and cut fees to a minimum.

MATIC is the native token powering the Polygon blockchain. The coin is up by more than 9,000% for the year, even as other cryptocurrencies have been declining.

Why Polygon stands out

Unlike other blockchain projects. Polygon offers developers a suite of tools that they can use to create ultra-high-performance decentralized applications (dApps). It also stands out partly because it is the only scalability solution that supports Ethereum virtual machines, thus allowing the interconnection of chains while retaining sovereign security.

Polygon also comes with arbitrary message passing capabilities that allow interconnected blockchain to send messages. Therefore, developers can build interoperable decentralized applications, thus leverage the properties of multiple chains at scale.

Building applications on Polygon is the same as building on Ethereum, given the interoperability that exists. Therefore, all applications built on the blockchain are accessible to the biggest blockchain development community.

Recent Developments

At a time when most cryptocurrencies have underperformed, posting double-digit losses, Polygon native currency MATIC has remained resilient. Its outperformance stems from increased institutional interest, most notably from billionaire investor Mark Cuban who has invested in it heavily. He insists the platform is a well-structured, easy-to-use, and ideal solution for Ethereum scaling and infrastructure development. The Polygon network is “destroying everybody else,” Cuban recently told reporters.

GETTING TECHNICAL

BTC/USD

A snapshot of Bitcoin’s spot price as of this writing is $29,213.34 representing a 0.62% increase in trading volume since June 22nd at 10:10 am. The current market cap represents 47.38% of total cryptocurrency traded. Bitcoin remains the top cryptocurrency trading with a circulating supply of 18,740,500 BTC, an increase of 575 overnight. The 30-day volatility of BTC is 76.74%, a 2 bps decrease since last night.

ETH/USD

ETH is trading at $1,722.14 as of this writing, representing a 7-day decline of 32.84%, a 24-hour decline of 0.76%, and 30-day volatility of 105.86%. Over the last 24 Hours, the trading volume increased by 6.24%. As of today, ETH holds 17.32% of the cryptocurrency market, making it the second-largest coin traded. It has a circulating supply of 116,393,390 coins, an increase of 11,180 since Monday.

THIS WEEK’S DEEP READ

Why Do Some Tokens Grow by More Than 1000%?

Source: NewsBTC

“These tokens with impressive growths are numerous but for this article, an exploration into the following high yield tokens will be made.”

Just in case you missed it, we released our report on NFTs a few weeks ago. It’s extremely detailed, and you’re going to get a lot out of it. To read this free report, click here.