Welcome to the 73rd edition of ‘The Digital Asset Digest’. Today, we look at the top 3 crypto firms preparing for their IPOs and discuss the biggest crypto flops of 2017.

SNIPPETS

A Revolutionary GM for an Evolutionary Cardano Based DeFi

Source: Bitcoinist

“ADALend’s GM hails from a better-suited background to tackle the problems facing the DeFi ecosystems plagued by professionals who have more to do with programming and less to do with financing.”

Source: U.Today

“According to analytics data provided by IntoTheBlock, the Huobi Bitcoin mining pool, the eighth largest in the world, has shifted almost 100,000 BTC, following the Chinese government’s recent crackdown on the crypto industry.”

Revolut to Reportedly Launch Own Cryptocurrency Token

Source: CryptoPotato

“According to a recent report, Revolut seeks approval from UK’s securities regulator to launch its exchange token. Should the initiative be greenlighted, it will start from Europe and other non-US-based locations.“

Filecoin Group Grants $5.8 Million to Edward Snowden’s Press Freedom Foundation

Source: Decrypt

“The Freedom of the Press Foundation, led by Edward Snowden, will use the grant to improve its SecureDrop tool.“

Bacon Protocol launches decentralized mortgage platform

Source: CoinTelegraph

“Decentralized mortgage lender Bacon Protocol officially launched on Tuesday, allowing cryptocurrency investors to participate in the housing market through a new stablecoin that’s backed by USD Coin (USDC) and home loans.“

TOP GAINERS

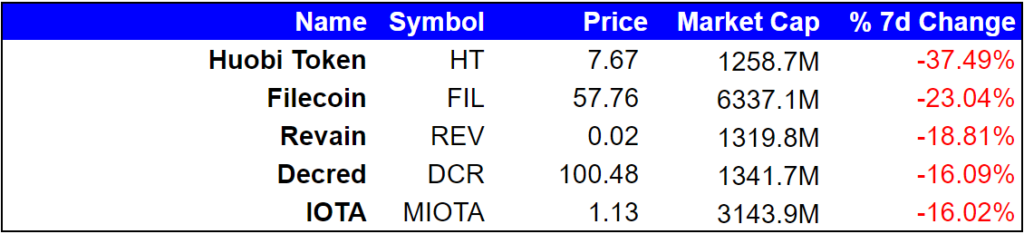

TOP LOSERS

INDUSTRY WIDE SNAPSHOT

MARKET BREAKDOWN

Where are They Now? The Biggest Crypto Flops of 2017

Innovation is never in a straight line. Every new technological wave has had a handful of big winners and a long list of early losers. We now know that Bitcoin, Ethereum, Coinbase, Metamask, and Binance are the most successful players in the digital assets sector. But developers, investors, and users can learn just as much from the projects that failed during previous market cycles.

With that in mind, here’s a look back at the projects that surged during the 2017 bull run only to collapse into obscurity.

EXPLORING NEW IDEAS

Top 3 Upcoming Crypto IPOs

Despite their growing popularity, digital assets remain a fraction of the value of traditional asset classes. Public equity is worth $37 trillion – roughly 16 times the size of the entire cryptocurrency sector.

With this in mind, some crypto companies have been reaching into the public stock market to tap into more growth capital. Several Bitcoin mining firms and payment processors have listed on stock exchanges since 2017. This year saw Coinbase list on the NASDAQ – marking one of the biggest Initial Public Offerings (IPOs) of the year.

As we enter the last quarter of 2021, here are some other crypto firms gearing up for similar IPOs.

TOKEN OF THE WEEK

Synthetix

Synthetix is a decentralized issuance protocol that allows people to create synthetic assets often referred to as Synths on the Ethereum blockchain. In simple terms, it is a piece of software that allows people to develop crypto assets that can mimic real-world assets such as the dollar, euro, or Bitcoin.

Here’s a closer look at our token of the week.

THIS WEEK’S DEEP READ

Is There An End In Sight For China’s Cryptocurrency Dominance?

Source: ZyCrypto

“The People’s Bank of China has declared all cryptocurrency transactions in the country as illegal and cryptocurrency exchanges outside China providing services are also operating illegally. While this sort of announcement is nothing new in the ecosystem, its effects remain profound for investors.“

Last week, our final report in the series on Metaverse implementations came out. This 15+ page report on Upland is available for free download, with more reports to come.