Welcome to the 56th edition of ‘The Digital Asset Digest’. Today, we discuss the most well-funded crypto startups and inspect how different countries tax cryptocurrencies.

SNIPPETS

Vitalik Buterin On How The World’s Second-Largest Cryptocurrency Was Named

Source: ZyCrypto

“A now-abandoned scientific theory about matter, light, space, and electromagnetism has been discovered to be Vitalik Buterin’s muse in the naming of Ethereum eight years ago.”

This NFT protocol is going to change everything for NFTs

Source: CryptoSlate

“The NFT market is mostly limited to buying and selling digital collectibles. But a new protocol aims to bring new use cases to the burgeoning sector.”

Bitcoin ETP Launching on London Exchange

Source: BeInCrypto

“Crypto product provider ETC Group is launching its bitcoin-backed exchange-traded product (ETP) on a UK exchange using Swiss trading rules. “

Crypto exchange Korbit launches NFT marketplace in South Korea

Source: The Block

“South Korean crypto exchange Korbit has launched a non-fungible token (NFT) marketplace, enabling NFT creators and investors in the region to participate in the NFT ecosystem. Korbit claims this will be the first NFT marketplace in South Korea.”

Central Bank Governor Says Crypto Regulation is Likely

Source: Crypto Briefing

“The governor of Sweden’s central bank thinks that “there’s good reason to believe” that crypto will be regulated, Bloomberg has reported.”

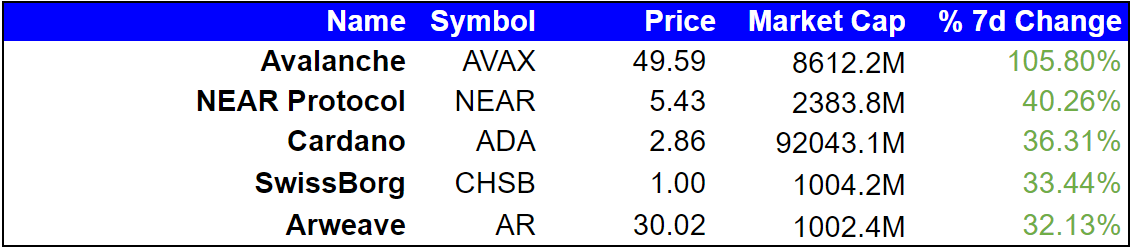

TOP GAINERS

TOP LOSERS

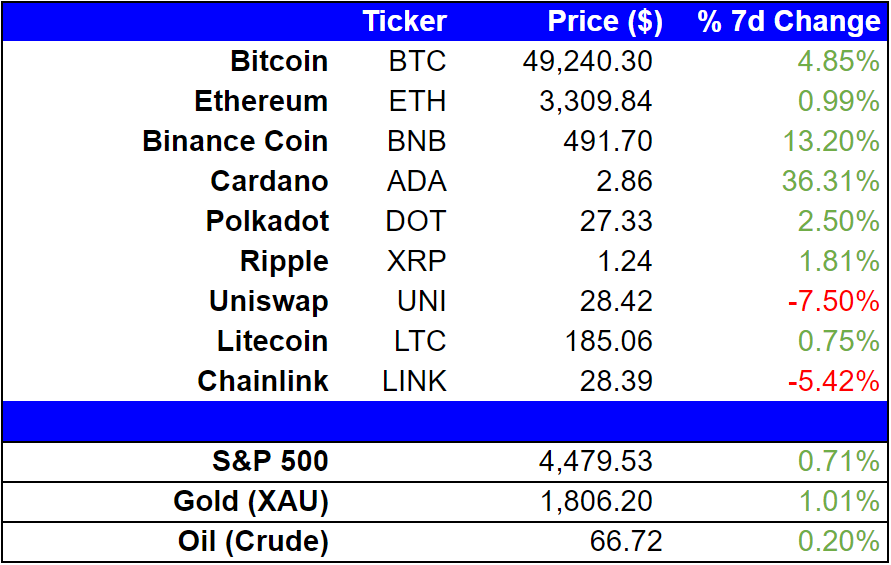

INDUSTRY WIDE SNAPSHOT

MARKET OUTLOOK

Most Well-Funded Crypto Startups

At the time of writing, the cryptocurrency sector is collectively worth $1.6 trillion. However, that figure represents the aggregate value of all digital assets. The companies building these assets or new tools on existing blockchains have been raising capital too. In fact, venture capitalists and angel investors have poured billions into crypto startups over the past decade.

Here are some of the most well-funded crypto startups in 2021.

Coinbase

Nine-year-old cryptocurrency exchange Coinbase earns the distinction as the most well-funded crypto company in the industry and the only one to be publicly listed thus far. At the time of writing, the company’s market capitalization is $49.4 billion, which puts it on par with household names such as eBay and HP Inc.

Kraken

Rival cryptocurrency exchange Kraken could join the public markets soon. The San Francisco-based company has raised $118.5 million through 12 investors over 9 funding rounds. Now, the team has filed to go public at a potential $4 billion valuation.

Circle

Boston-based Circle was created to deploy an Ethereum-based stablecoin called USDC. The company has partnered with Coinbase and several other major crypto institutions to govern the USDC protocol through a membership-based consortium called Centre. Meanwhile, Circle allows users in the U.S. to use mainstream credit or debit cards to buy USDC, earn a yield on the digital assets and deploy crypto-based payment solutions.

Circle has raised $711 million over four funding rounds that have included major investors such as Fidelity, a16z, and Goldman Sachs.

Compound

San Francisco-based Compound allows developers to “unlock a universe of open financial applications.” In other words, it lets devs build applications on smart contracts that offer interest on digital assets – otherwise known as decentralized finance or DeFi.

Founded in 2017, the company has already attracted $33.2 million in total funding from heavyweight investors such as Bain Capital and a16z. That makes it one of the most well-funded projects in the DeFi space.

Chia Network

The Chia Network is a new blockchain and smart transaction platform built to be more user-friendly than traditional platforms. Created by Bram Cohen, the inventor of BitTorrent, the network uses a unique programming language called Chialisp. It also replaces the traditional Proof-of-Work and Proof-of-Stake consensus models for less energy-intensive Proofs of Space and Time frameworks.

Chia is, perhaps, the youngest startup on this list. It was launched in 2017 but its platform went live this year. The team has raised $69.7 million in funding from investors including Naval Ravikant and TrueVentures.

Open Sea

The boom in digital asset valuations last year was led by the introduction of a new asset type: non-fungible tokens or NFTs. OpenSea is one of the first NFT marketplaces to emerge from the boom. However, the company’s most well-known projects, including CryptoKitties and Decentraland, date back to the crypto boom of 2017. The company has raised $27 million from investors including a16z, Naval Ravikant, Mark Cuban, Alexis Ohanian, Dylan Field and Linda Xie.

EXPLORING NEW IDEAS

Crypto Taxes Across the World

The emergence of a new asset class is an unusual phenomenon. This is why regulators and governments struggle to grapple with the emergence of Bitcoin and digital assets in recent years. While some countries have clamped down on this industry before it blossoms, others have embraced it and made it part of the tax code. This cements its position as a legitimate asset class for investors.

Here are the many ways crypto-friendly countries across the world tax Bitcoin transactions and digital assets.

Canada

For tax purposes, the Canada Revenue Agency treats cryptocurrency as a commodity. That means transactions with digital assets are considered either business income or as a capital gain depending on the circumstances. If cryptocurrencies are used to purchase goods or services, the CRA considers it a “barter transaction,” which involves its own set of tax implications.

It’s worth noting that Canada’s stock market is one of the few major exchanges in the world with publicly-listed Bitcoin and Ethereum ETFs. These ETFs may qualify for investors’ tax-free savings accounts.

United States

The IRS proactively collects information regarding crypto transactions. Every American taxpayer must answer the question “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” in their annual tax return. Virtual currencies are taxed as property, or as an investment, in the U.S.

Tax-free jurisdictions

Other parts of the world are arguably more lenient with taxes on digital assets. Nearly seven countries do not tax crypto transactions.

The German government, for instance, doesn’t consider digital assets “currency.” As such, these transactions are exempt from Value-Added Tax, and investments in Bitcoin held for more than a year qualify for the capital gains tax exemption. Similarly, Singapore considers short-term crypto transactions as business income and taxes it accordingly. However, if the digital assets are held for a longer duration they can be sold without tax implications because Singapore doesn’t have capital gains taxes.

Malta’s efforts to brand itself as “Blockchain Island” have helped it deliver some of the most investor-friendly taxes in the world. Crypto transactions are not taxed on this island. However, if the transaction occurs within a single day, it is considered as business income from day trading, which has some tax implications.

Other countries with low or minimal crypto taxes include Portugal, Belarus, Malaysia, and Switzerland. These lenient tax rules have helped these nations attract crypto talent, wealthy migrants, entrepreneurs, and capital from across the world.

Summary

Tax authorities may have been unprepared for the emergence of a new digital asset class. This is why crypto transactions are classified and taxed differently across the world. As the industry matures, these tax rules could potentially be more aligned. However, the current disparity pushed talent and capital to crypto-friendly jurisdictions for now.

TOKEN OF THE WEEK

Maker

The decentralization of finance should, theoretically, also lead to the decentralization of organizations. The first experiment in this was the Maker Decentralized Autonomous Organization (DAO) and its associated token – MKR. This project paved the way for a completely reimagined governance framework for crypto projects.

Here’s a closer look at this token’s impact on the digital assets sector and its implications for the future of the global economy.

Background

Developed in 2015 by Denmark-based programmer Rune Christensen, Maker was one of the earliest Decentralized Finance (DeFi) projects. The platform’s core product is a stablecoin – Dai – which uses smart contracts to maintain its peg to the U.S. dollar instead of relying on banks and auditors.

Instead of relying on monthly statements and auditors to prove reserves, the Maker project uses smart contracts built on the Ethereum network to maintain its stablecoin. MKR token is used to maintain the Dai-to-USD peg. So MKR is issued or burned to sustain the DAI peg. MKR is also used to pay fees on the network and as a governance token for holders who want to vote on the operational issues for the project.

Use Cases

Like any other stablecoin, Dai is used by traders and investors as a safe haven asset that isn’t as volatile as traditional digital assets. These stablecoins can be held in reserve or used for transactions.

What separates Dai from other stablecoins is that it’s maintained by a DAO rather than a traditional organization. The holders of MKR tokens are the investors or shareholders that help maintain the supply of Dai and keep the project running. This makes the project open and transparent as anyone can simply check the blockchain to verify transactions, reserves, and governance decisions.

Tokenomics

Maker’s underlying framework is a little complicated, but investors must make an attempt at understanding how it all works.

The key to this protocol is a smart contract known as the Collateralized Debt Position (CDP). Anyone can deposit any Ether or ERC-20 token to this smart contract and get DAI in exchange as a loan. As long as the value of the Ether held in deposit is greater than the Dai outstanding, the value of Dai will remain stable at $1.

However, since Ether and ERC-20 tokens are volatile there is a chance that the value of this collateral falls dramatically. If the value falls below a certain threshold, MKR tokens are issued to fill the gap. In this way, MKR tokens stabilize the protocol and help sustain Dai’s peg to the U.S. dollar.

At the time of writing, the total value locked in the CDP is $7.6 billion, while there are 991,501 MKR tokens in circulation and each Dai is worth $1.0003.

Recent developments

The Maker project has maintained its position on the bleeding edge of DeFi. This month, the project issued its first “real world” loan. MKR holders voted to issue $38,000 of dai stablecoins to finance a mortgage loan. This opens the gate for Maker’s smart contract to accept real estate as collateral for its smart contract. It also marks the first time a DeFi project has been used to finance the purchase of a real-world asset such as property

GETTING TECHNICAL

BTC/USD

This week, the Bitcoin price has consolidated with a trading range of $9,430 and the price opened the week at a low of $31,327, which reached a local high of $40,757 shortly before falling to the mid-range of $30,000 USD.

Bitcoin spot price is $37,038.12 as of this writing with a 24-hour trading volume of $37,028,243,571 USD and 24-hour price change of +3.29%.

Bitcoin Market cap represents 42.39% of cryptocurrency traded –the most popular cryptocurrency traded with a circulating supply of 18,722,937 coins.

ETH/USD

Ethereumspot price as of this writing is $2,631.17with a 24-hour trading volume of $29,706,075USD.

Ethereum is up 10.63% in the last 24 hours and traded in the range of 24L $2,279.51to 24H $2,675.25, the 30-day volatility is 1.66. As of this writing, ETH market dominance is 18.82% representing the second-largest cryptocurrency traded and has a circulating supply of 116,101,049 coins.

WEEKEND READ

What’s up with Taproot, the biggest proposed change to Bitcoin since 2017?

Source: Forkast

“Bitcoin’s proposed Taproot update for smart contracts and privacy has wide verbal support from miners, but will they put their crypto where their mouth is?”.