Welcome to the 24th edition of ‘The Digital Asset Digest’. Over the last few weeks, we’ve been getting into the DeFi world and how that affects broader dynamics. We’re still very skittish in this market, as it seems like all sectors bear a lot of risk right now. However, assessing risk and rewards is what good investing is all about.

DIGITAL ASSETS

Bitcoin, Ethereum, and Ripple all took a minor tumble this week, with returns of -3.33%, -7.33%, and -5.70%, respectively. These types of swings are natural, but what is notable is that yearn.finance went from one of the top winners, to the 2nd highest loser, with losses of 37.77%.

INDICES

Equities markets continue to trend flat with the NASDAQ down 3.04% and the S&P 500 down 3.18% on the week. We’re seeing a trend of investors not really knowing where to put their money, with nearly every asset bearing its own risk in the current economic uncertainty.

COMMODITIES

Crude oil is slightly in the green this week, with returns of 2.77%. It is slowly climbing back, but investors are still worried after the Q2 drop we saw in the market. Gold was down 2.98% this week, which mirrors the returns of Bitcoin. As investors wise up to what the Federal Reserve is doing, they are going to come looking for safe investments. Until then, they will probably stay flat.

Source: CoinMarketCap

“One of the largest stories in recent weeks in crypto has been SushiSwap’s short, yet eventful history. To recap, SushiSwap is a fork of most of Uniswap’s code and was announced on August 27. The key difference is that SushiSwap provides liquidity providers with an additional liquidity mining reward in the form of its governance token, SUSHI, while Uniswap provides 0.3% of trading fees (which SushiSwap does too). This scheme has been called by many vampire mining, as SushiSwap “sucked out” Uniswap’s liquidity.”

First Mover: Digital Gold Narrative Could Be Bitcoin’s Lone Ace as Ethereum Gains

Source: CoinDesk

“The rivalry between Bitcoin ‘maximalists’ and Ethereum enthusiasts has become more polarized in recent months, with each side latching on to narratives that best support the asset to which they have pledged their allegiance,” Kevin Kelly, co-founder of the market-analysis firm Delphi Digital, wrote this month in a report. And recently, Ethereum has been “playing catch-up to its ‘digital gold’ counterpart.”

Bitcoin Is About To See Its Largest Quarterly Options Expiry Ever

Source: Barchart

“One factor that could contribute to the cryptocurrency’s volatility in the near-term is the imminent expiry of 87,000 quarterly BTC options contracts. Traders rolling over these positions or moving to cover them before the close could catalyze some turbulence.”

TOP GAINERS

TOP LOSERS

INDUSTRY WIDE SNAPSHOT

Options for Hedging the DeFi Market Risk

Source: Deribit

“The reality is, most crypto traders are not equipped to spot this market trend. DeFi is unique in that it is not on exchanges. There are no order books, and there is no long vs short ratio. The tools to better anticipate market corrections are just being developed. And since these developments are so new, the first wave of traders adopting these methods and techniques will reap the rewards. Which is also the aim of this article – to demonstrate the opportunity at hand.”

Source: Trading View

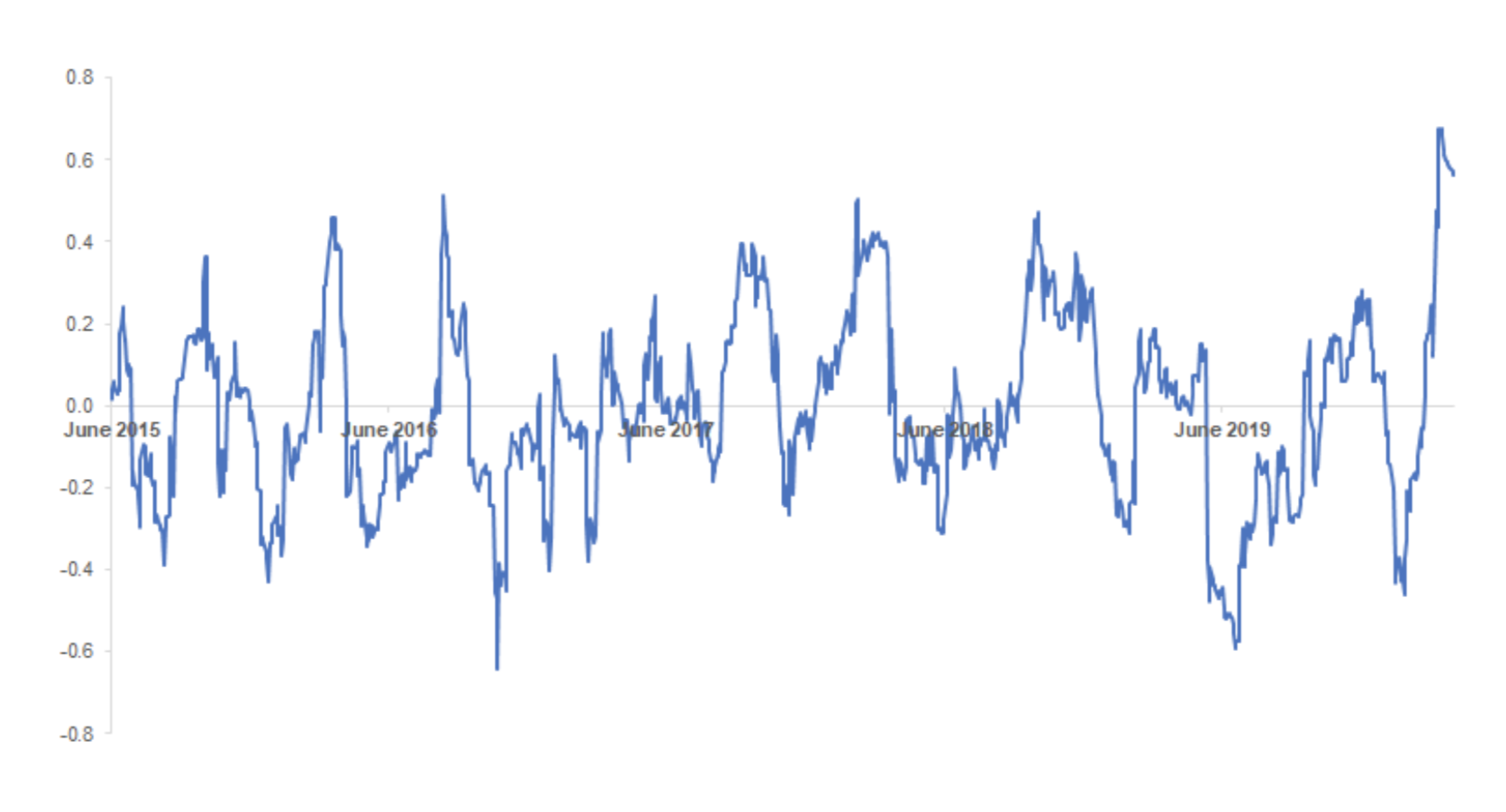

This has been a less-than-exciting week in the Bitcoin world, and our bullish outlook is temporarily going to turn bearish. Looking at the 5-day chart, it’s easy to see how constrained Bitcoin has been recently.

While failing to climb back up to $12k, it has also not fallen below $10k. The $10,400 level continues to be where BTC lingers. Looking at the Relative Strength Index, BTC flirted with being overbought. Plus, the Relative Volatility Index is around 40, which is usually a sign to sell.

Add all that together with the observation that BTC has been sitting flat for most of the day, and we think a big move is about to happen. The indicators make us think that will be bearish, but time will tell whether the bears can get the traction they’re constantly looking for.

This concludes another issue of the ‘Digital Asset Digest’. Next week, we are going to begin our DeFi briefing column. This will start off basic, with items like “What is Yield Farming?” and “How Do I Invest In BurgerSwap”, but will get progressively more advanced as we move forward.

If you enjoyed this edition of the Digital Asset Digest, then click here to subscribe and have updates sent to your inbox on a weekly basis!

As always, thanks for reading and we hope to hear from you soon.