Welcome to the 53rd edition of ‘The Digital Asset Digest’. Today, you get a primer on the Metaverse, our take on Ethereum’s recent run, and our pick for the token of the week.

SNIPPETS

Source: Trustnodes

“One swap transaction on ethereum now costs more than $300 (pictured) as the ethereum network becomes fully congested.”

Polkadot Integrates “Smart Trigger” Platform PARSIQ

Source: Crypto Briefing

“PARSIQ is a platform that uses “smart triggers” to send transaction alerts to users. It acts as a bridge between chains and off-chain applications.”

NiiFi raises $3 million in seed round to bring instant finality to DeFi

Source: Cryptoslate

“NiiFi, a new decentralized exchange (DEX) and lending protocol aimed at mainstream use cases, today announced that it has successfully closed a $3 million seed round, as per a press release.“

Thailand’s Brooker Group bets US$48 million on DeFi, decentralized apps

Source: Forkast

“Bangkok-headquartered financial consultancy and capital manager The Brooker Group is set to invest US$48 million in a portfolio of decentralized applications and decentralized finance tokens, a move that will see the company commit around half of its assets to the sector.”

FTX Trading Volume Surpassed $400 Billion in April

Source: BeInCrypto

“FTX has become one of the world’s largest cryptocurrency exchanges after surpassing $400 billion in trading volume in April.”

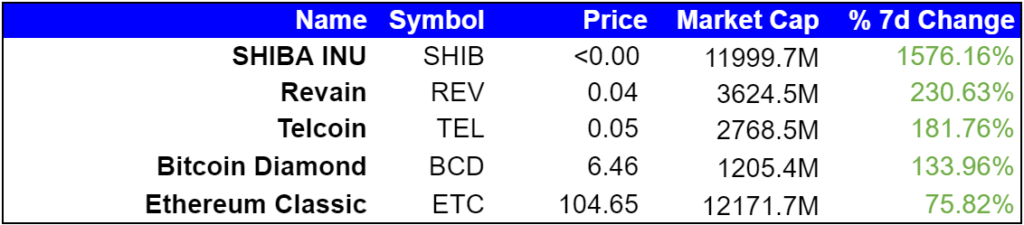

TOP GAINERS

TOP LOSERS

INDUSTRY WIDE SNAPSHOT

MARKET OUTLOOK

Ethereum Gets Close to Challenging the King of Cryptocurrencies

Price dynamics in the digital asset sector have caught even some experts off guard this week. The most noteworthy move was in the world’s second-most popular cryptocurrency: Ethereum. The price of each Ether is up 33% over the past week and a jaw-dropping 400% year-to-date. Some believe the market value of the Ethereum ecosystem could eclipse the Bitcoin network in the near-future.

Here’s a closer look at what’s driving this shift in investor and developer sentiment.

The law of large numbers

Bitcoin’s value has been relatively range bound since February. At the time of writing, each BTC is worth $57,420. That’s the same price it was trading at on February, 21.

Part of the reason for Bitcoin’s stagnation could be the law of large numbers. At its current value, the market capitalization of the Bitcoin ecosystem is roughly $1 trillion. That makes it one of the most valuable assets in the world, larger than most publicly-traded corporations and the GDP of several nations. At that scale, incremental growth is more difficult since the base is already too large.

For instance, an additional billion in investor inflow will only add 10% to BTC’s value, while it would have added 100% a year ago.

Ethereum’s development ecosystem

Ether has been surging ahead as adoption expands. The market value of the Ethereum ecosystem is now hovering at $480 billion – roughly half the size of Bitcoin’s overall value. If it can sustain its current bull market, Ether’s market value could surpass Bitcoin relatively shortly.

Driving this unprecedented surge is the growing utility of the Ethereum network. In recent years several kep applications have emerged on this decentralized protocol. According to Dapp Radar, the most popular Ethereum projects are decentralized exchange Uniswap, NFT marketplace OpenSea and NFT art engine CryptoPunks.

Growing interest in Decentralized Finance, or DeFi, could be another engine driving Ether higher. Rumors suggest hedge fund billionaire Daniel Loeb could be staking his crypto assets, making him perhaps the first celebrity billionaire to adopt DeFi.

A growing number of users have considered borrowing or lending cryptocurrency to boost returns. The confluence of smart contracts and digital currencies is leading to innovative new financial products, such as flash loans, no-loss lotteries and streaming money. The staking, lending and borrowing of digital assets could be becoming more mainstream, which is probably pushing network fees higher on Ethereum.

Put simply, greater utility and adoption is making ETH nearly as valuable as BTC.

Final Thoughts

Ethereum has outperformed in recent months. The value of the network is now roughly half the value of Bitcoin’s combined market cap. Some believe the two could switch places, which would make Ethereum the world’s largest cryptocurrency project. For now, mainstream adoption of Ether is still nowhere near BTC. However, as developers add new and unique decentralized applications and financial products to the network, its growing utility could drive prices higher.

EXPLORING NEW IDEAS

What is the Metaverse?

From smartphones to reusable rockets, several concepts have crawled their way from science fiction to everyday reality. Theoretical concepts that are first depicted on the big screen are often deeply rooted in reality. One such concept seems to be completing this transition right now: the metaverse.

The term was first coined in Neal Stephenson’s 1992 science fiction novel Snow Crash. The novel depicts a three-dimensional space that allows human users to interact in real-time. In Stephenson’s vision, this dimension was the natural evolution of the internet. However, in 1992 the web itself was in its infancy. The bandwidth needed to stream real-world 3D objects in real-time was nowhere near the horizon. Now it is.

The confluence of high-speed broadband, better digital animation engines, cheaper computing power, and digital currencies are creating the metaverse science fiction writers imagined not too long ago. This new sphere of the internet could unlock new commercial opportunities for developers and investors.

The state of the Metaverse

Expensive virtual worlds are already commonplace in the gaming industry. With over 1.5 billion sq. miles. of surface area, Minecraft has the largest land-based open world. No Man’s Land, on the other hand, operates on a much larger scale, with 255 galaxies spread across a nearly infinite procedurally generated universe.

Some open-world games, like Roblox, have managed to create self-contained ecosystems for players to interact in social and commercial ways. Children under the age of 13 were more likely to interact with their peers on Roblox than on any other social media platform last year. Robux, the game’s built-in virtual currency, adds a commercial element to these social interactions.

Meanwhile, companies like Facebook are making these virtual worlds more immersive. Facebook Horizon, built on the Oculus device platform, is the social media giant’s vision of the metaverse. The product signals the fact that the most successful social media company views the metaverse as a natural evolution of the conventional internet.

Meanwhile, crypto projects such as Decentraland and non-fungible tokens (NFTs) are grappling with the idea of scarcity in the metaverse.

The road ahead

Better devices, greater functionality, and wider adoption are needed to make the metaverse a mainstream reality. Heavyweights like Apple and Microsoft are working on augmented reality devices that could solve the biggest bottleneck for this sector in the years ahead.

With more functionality and wider adoption, a metaverse platform could serve as the best place to sell digital goods, offer virtual services, acquire digital assets and build unique solutions.

For corporations and investors looking to stay on the cutting-edge of digital technologies, experiments in the metaverse are certainly worth taking a closer look at.

Final thoughts

With better bandwidth, connectivity, the rise of digital assets, and cheaper computing power, the concept of a metaverse is gradually becoming a reality. The nascent sector is attracting tremendous capital and talent from the tech industry, which has quickened the pace of development. Investors and developers may want to position themselves for a new layer of the internet that could create tremendous value in the years ahead.

TOKEN OF THE WEEK

USDC

Digital assets have gained some acceptance as stores of value and legitimate vehicles of investment. However, their volatility has prevented them from being a reliable means of exchange. Users simply cannot use digital currencies for everyday transactions if the value of their tokens are likely to fluctuate before the transaction is even completed.

To solve this issue, developers have created a new form of cryptocurrency that is collateralized by conventional fiat. These new digital assets are much more stable than their free-floating counterparts, which is why they’re called “stablecoins.”

The most popular fiat collateral, unsurprisingly, is the U.S. dollar. One of the most popular stablecoins is this week’s token: USDC.

Background

Launched in September of 2018, USD Coin is a stablecoin backed by the U.S. dollar. The token is managed by a consortium called Centre that includes peer-to-peer payments technology company Circle, Bitcoin miner Bitmain and cryptocurrency exchange Coinbase among others.

The coin is designed to work across several blockchain networks, including Ethereum, Solana, Stellar, and Algorand. Meanwhile, the U.S. dollar reserves are regularly audited by Grant Thornton, LLP, one of the largest auditors in the world.

At the time of writing, the USDC network had handled transactions worth over $717 billion. There are over 15.1 billion USDC in circulation.

Use Cases

An audited and verified stablecoin serves as a safe shelter for crypto investors. Most digital assets can be easily converted to USDC when traders want to book profits or stem their losses. It can also serve as a reserve asset for investors waiting on the sidelines.

USDC can also be used to generate a passive yield that is far higher than the interest rates earned on traditional US dollar savings accounts. The current yield on USDC ranges from 0.15% to 11% on various DeFi platforms. This passive yield can boost overall returns for investors.

Converting cryptocurrencies to stablecoins such as USDC is more convenient than converting back into fiat. Although the tax implications of such a transaction aren’t clear yet.

Tokenomics

USDC is an ERC-20 token that is backed 1-1 with U.S. dollars. Grant Thornton, LLP audits and verifies the U.S. dollars held in reserve on a monthly basis. The dollars are deposited by paying members of the Center consortium. To become a member and start issuing USDC, an organization needs to comply with rules in their local jurisdiction, international AML/KYC standards, hold U.S. dollar reserves to back each USDC token they issue, and comply with other rules set forth by the consortium.

Based on this open-source framework, any organization can participate in the USDC network and plug the growing demand for stablecoins in the digital assets industry.

Recent developments

Global payments giant, Visa, recently adopted USDC to settle transactions on its payment network. This week, the Visa team partnered with Tala, a mobile lending service in emerging markets, to bring USDC to emerging markets such as Kenya.

GETTING TECHNICAL

BTC/USD is trading with a bearish tone over the past few sessions: Over the past seven days, BTC is down 4.85%. Several macro and technical factors are at play:

- Fear of inflation is weighing on tech stocks

- Decoupling of BTC and U.S. dollar (DXY). BTC has been gaining ground against the weaker greenback but there is a marked inflection since mid-April where BTC has entered a consolidation phase with USD picking up vis-a-vis the major currency pairs.

- A shift in market participant sentiment leaning toward alts, defis and ETH protocol

BTCUSD remains inside the consolidation bubble (purple) and a break below from here will push the pair to first Fibo support near @ 50,235 and put pressure on the April 25th ($47k). Momentum as measured by RSI, in the lower pane, is still in bearish mode, diverging from price actions.

We remain cautious in the short term as market participants ponder on the next directional move. In the medium term, the outlook is much more positive since BTC perpetual futures open interests have reset and the hash rate has recovered nicely after the blackout event.

WEEKEND READ

VORTECS Report: NewsQuakes boost DOGE hype, while TEL score rings a bell for traders

Source: Coin Telegraph

“What can you say about Dogecoin that hasn’t been said before? How about this: Elon Musk’s tweets aren’t the only thing that let the DOGE out.”

CLOSING THOUGHTS

After a long hiatus from reports, you can look forward to our NFT report at the end of this week. It will be sent right to your inbox!