Welcome to the 60th edition of ‘The Digital Asset Digest’. Today, we look at the 3 tech giants developing the metaverse, and explain how Bitcoin’s stock-to-flow model works.

SNIPPETS

Legendary Football Player Tom Brady to Take Equity Stake in FTX

Source: CryptoPotato

“The American sports legend Tom Brady has doubled down on his cryptocurrency endeavors by taking equity in the digital asset exchange FTX.”

13 more crypto firms withdraw licensing applications in the UK

Source: CoinTelegraph

“The United Kingdom Financial Conduct Authority’s (FCA) crypto licensing regime is reportedly proving arduous for cryptocurrency businesses looking to operate in the country.”

Crypto Punks Market Activity Grows Quarterly. Why Exactly?

Source: U.Today

“Approximately every 3 months, market activity on Crypto Punks increases. Analytical service Dune drew attention to the hype cycles of the most famous NFT tokens, which has a duration of three months.“

What kind of new regulation can help Australia become a global crypto hub?

Source: Forkast

“Australian crypto and financial insiders have until end of day tomorrow to finalize submissions for the most comprehensive re-evaluation of Australia’s crypto regulation in recent years.“

Ark Invest Lending Name to Swiss Bitcoin ETF

Source: BeInCrypto

“21Shares US LLC, an affiliate of Zug, Switzerland-based 21Shares AG, is sponsoring the proposed ETF, with Ark providing marketing assistance. Trading under ARKB, the ETF will track the performance of bitcoin as measured by the S&P Bitcoin Index.”

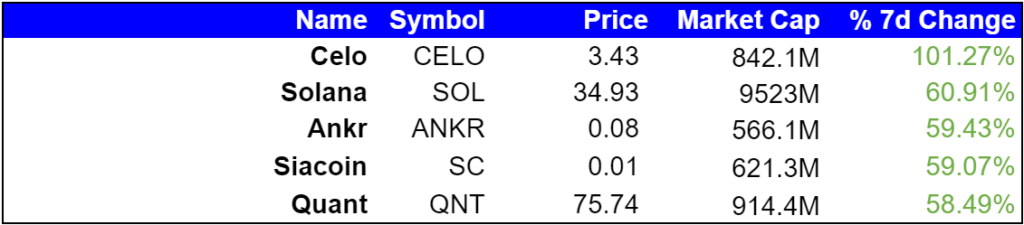

TOP GAINERS

TOP LOSERS

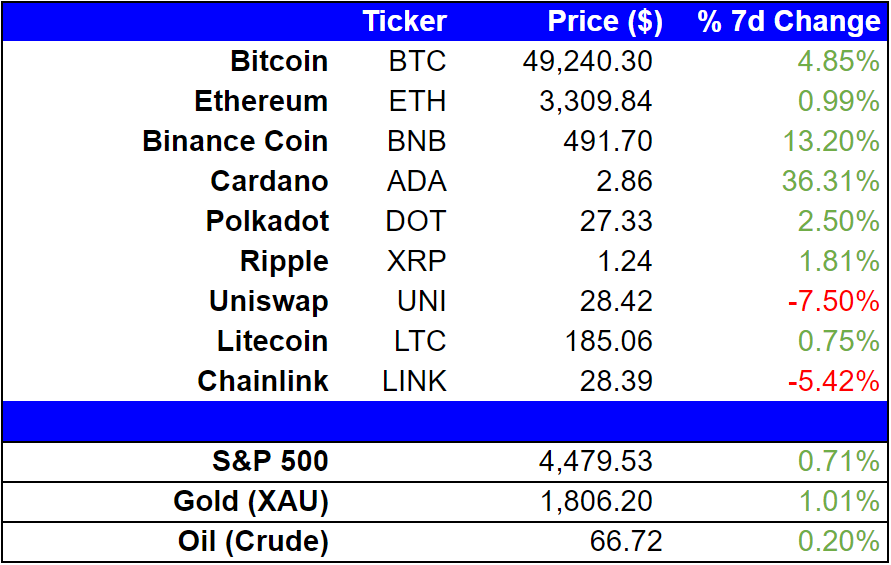

INDUSTRY WIDE SNAPSHOT

MARKET OUTLOOK

Bitcoin’s Stock-to-Flow Model

Bitcoin’s volatility and unpredictability is no secret. Industry veterans simply assume the asset’s price will fluctuate beyond measure on any given day. Since its inception, predicting the price of Bitcoin has been nearly impossible. However, some experts in the community have adopted niche financial models in an attempt to figure out Bitcoin’s price patterns.

One such model has gained significant attention in recent years because of its relative accuracy. Here’s a closer look at the “Stock-to-Flow” model and what it indicates for the future of this digital asset.

The stock-to-flow model

The stock-to-flow model assumes that certain goods have value simply because of their scarcity. The item that fits this category perfectly is gold. Gold’s relative rarity made an ideal form of currency and is now considered the basis for its safe-haven status.

Macroeconomists apply the stock-to-flow model to measure the rarity of gold and, in turn, its valuation. The ratio simply divides the stock of gold that currently exists to the flow of new gold mined every year. Gold’s stock-to-flow ratio has been relatively stable at around 60 for the past decade.

Gold investors compare this steady flow of gold to the rate of inflation in the money supply (M3) to figure out a justified price of an ounce of gold measured in U.S. dollars. In other words, Gold’s value is stable while the dollar is losing value which is why the metal should be worth more.

A few years ago, Dutch institutional investor who operates under the Twitter account “PlanB,” applied this model to Bitcoin for the first time. He also made adjustments for Bitcoin’s halving events that dramatically cut the flow of new BTC into the system. The result is a chart that lays out Bitcoin’s expected future price.

Bitcoin’s future

Bitcoin’s hard cap on total supply (21 million) and its predictable rate of flow (6.25 BTC per block mined) makes it an ideal fit for the stock-to-flow model. It also makes it far rarer than gold or the U.S. dollar, which should imply a higher valuation.

According to the model, each BTC is currently worth US$73,794. BTC’s market price at the time of writing is roughly $32,750. In other words, the digital asset is significantly undervalued. In fact, Bitcoin has been this cheap relative to intrinsic value only a few times over the past decade.

The model also predicts that the value of each BTC exceeds $100,000 before the end of 2021. A swift rebound in the asset’s market value would cement this model’s predictive capabilities.

Final takeaway

The stock-to-flow model has traditionally been used to measure the value of gold and other precious metals. Its core assumption is that certain goods are worth more simply because of how rare they are and how difficult it is to generate new units of the commodity.

Assuming Bitcoin is digital gold, this model should accurately predict its near-term price. Whether or not BTC reaches an all-time high of $100,000 this year, as the model predicts, remains to be seen.

EXPLORING NEW IDEAS

3 Tech Giants Creating the Metaverse

In 2021, the metaverse is finally going mainstream. Younger users are already familiar with this emerging new dimension of the global internet. Special avatars, unique player abilities, designer costumes, and digital products are already a multi-billion-dollar business on specific platforms.

The metaverse is still in its early innings, just like social networks and mobile applications were in the early-2000s. Investors, developers, and entrepreneurs need to keep an eye on the tech giants enabling this shift to discover new opportunities.

Here are the top three tech giants developing the metaverse.

The social media giant is undoubtedly the biggest player in this arena. Facebook’s investments in the metaverse are a clear signal that it’s trying to dominate a segment of the internet before its current gatekeepers – Google and Apple – jump in.

The company’s Oculus devices are already some of the most popular virtual reality headsets on the market. Now, Facebook Horizon adds a social element to the VR experience, helping billions of Facebook, Instagram, and Whatsapp users connect in the metaverse.

With over $64 billion in cash on hand and roughly 10,000 employees working on AR and VR, Facebook is the clear frontrunner in this emerging sector.

Roblox

While Facebook is still trying to kickstart a gaming-based social experience, Roblox is already there. Roblox has over 42.1 million daily active users, the majority of whom are under the age of 16. Many of these younger players consider the platform a better way to socialize with friends, compared to traditional social networks. That’s helped the company grow to a phenomenal $50 billion market valuation.

The platform has already hosted some major events such as the introduction of DC’s WonderWoman, a Gucci-sponsored garden experience, and a live concert by Lil Nas X. Meanwhile, users have adopted the platform’s native currency Robux to pay for avatar upgrades and special abilities.

Unity

The most intriguing company in this industry is Unity Technologies. The company provides the tools developers need to create the metaverse experiences mentioned above as well as several others. Unity is a cross-platform game engine that has enabled early metaverse experiences such as Snap Inc.’s augmented reality platform, PokemonGo world, the VR metaverse of Oculus, and the Roblox platform.

The engine is so ubiquitous that over 1.5 million developers across the world currently rely on it. That puts UNit Technologies in a uniquely favorable position to dominate this emerging sector.

Takeaway

The rise of the metaverse is inevitable. Younger users are already accustomed to a highly interactive and social internet. They spend more on digital goods and experiences than movies or music. This represents a massive opportunity for early adopters and tech giants such as Facebook

TOKEN OF THE WEEK

Token of the Week: PancakeSwap

Decentralization is, by far, the most intriguing aspect of digital assets. Their ability to facilitate anonymous transactions while doing away with intermediaries such as banks underscores their growing need in the global financial sector. This feature is somewhat undermined by the fact that most cryptocurrencies and digital assets are still traded in centralized exchanges controlled by a single corporate entity. However, that is set to change with PancakeSwap in the mix.

What is PancakeSwap?

PancakeSwap is a distributed exchange that is not controlled by a single entity. It enables the trading of digital assets without the involvement of a centralized entity. It is also built on automated smart contracts deployed in the Binance Smart Chain.

Unlike Binance or Coinbase, the PancakeSwap exchange enjoys the highest level of decentralization, thus allowing people to trade their tokens without intermediaries. While PancakeSwap operates on a Binance Blockchain, Binance has no control of the decentralized exchange.

The exchange is popular with BEP-20 tokens even though it also accepts other tokens through the Binance Bridge.

Tokenomics

The DEX leverages the automated market maker model. What this means is that people can trade digital assets on the platform. However, instead of being matched with someone else while trading, the platform allows people to trade against a liquidity pool.

The tools come loaded with the user’s funds. Once people deposit funds in the exchange, they become liquidity providers on the platform. In return, people can use the allocated tokens to reclaim their share plus a portion of trading fees.

This means that one can simply trade their BEP-20 tokens or add liquidity to earn rewards. Rather than finding someone else who may want to swap the tokens you have or the ones you want, the exchange allows users to lock their tokens into liquidity via smart contracts.

In this case, people get to swap what they want while others get to keep their coins in the pool and earn rewards in return.

Use Cases

PancakeSwap is a rising cryptocurrency exchange that allows traders to conduct transactions with trade tokens without involving a middleman. In this case, it allows people to exchange one token for another without an intermediary.

In addition, those who stake their tokens in the exchange liquidity pools earn a share of the rewards generated by transactions. Additionally, the decentralized exchange allows people to stake coins into so-called Syrup Pools, which provide growing rewards. For instance, someone can stake CAKE, the network’s native token, and earn more by just letting the coin stay there.

Recent Developments

CAKE is the native cryptocurrency that powers the PancakeSwap network. There are more than 2 million people holding the CAKE coin in wallets, the total supply having reached highs of more than 173 million tokens. CAKE reached an all-time high of $44 in April. A fierce correction wave in the broader cryptocurrency sector has seen the coin plunge to about $13 a coin.

Additionally, in April, PancakeSwap made a transition to Version 2 for improved performance. In the transition, the decentralized exchange moved two of its existing smart contracts to new ones, resulting in new liquidity tokens. The change also allowed developers to create additional incentives by adjusting the fee structure.

GETTING TECHNICAL

BTC/USD

A snapshot of Bitcoin’s spot price as of this writing is $35,616.56 representing a 6.41% increase in trading volume since June 28th at 8 AM. Bitcoin remains the top cryptocurrency trading with a circulating supply of 18,744,493 BTC, an increase of 468 since Monday. The 30-day volatility of BTC is 80.53%.

ETH/USD

ETH is trading at $2,179.82 as of this writing, representing a 24-hour increase of 8.85%, and 30-day volatility of 88.57%. Over the last 24 Hours, the trading volume increased by 22.01%. As of today, ETH holds 17.52% of the cryptocurrency market, making it the second-largest coin traded. It has a circulating supply of 116,487,101coins, an increase of 11,262 overnight.

THIS WEEK’S DEEP READ

Just 77 Bitcoin Blocks Mined Within 24 Hours

Source: Trust Nodes

“Just half of the usual 144 daily bitcoin blocks have been mined in the past 24 hours according to our analysis of blockchain data.”

Just in case you missed it, we released our report on NFTs a few weeks ago. It’s extremely detailed, and you’re going to get a lot out of it. To read this free report, click here.